How to Pay Tax with Credit Card: Every US Citizen is liable to pay tax and file tax return. People often consider the IRS Tax as an expense, but it can be beneficial for them. Yes, you can earn profit by paying tax and we will explain how it can happen. You need to pay tax with a credit card and you will get many benefits.

Individuals are required to file their tax return and make payment by April 15, 2019. The freelancers and self-employed people are liable to make estimated tax payments on quarterly basis. When the taxpayers pay their tax with credit card, they can earn rewards, credit card bonus, reach spending threshold limit and some days till the credit card cycle gets over.

Last Date for Tax Payment and Filing IRS Tax Return

According to Internal Revenue Service, every taxpayer must file IRS Tax Return and Pay Tax by April 15, 2019. The deadline for payment of tax in current year will be midnight of 15th April. Whether you pay the taxes by check, debit card or credit card, it must be paid to U.S. Treasury by the said last date.

Different Ways to File IRS Tax Return

There are three ways to file tax return i.e. Online e-file, Offline form and via an Authorized e-file Provider. If you know how to file IRS Tax Return and required information then you should file it yourself. You can do it either online at IRS Website or mail the tax return form to IRS U.S. Treasury Address. In case you don’t know the rules & procedure of filing tax return then seek help of an authorized e-file provider to prepare and submit your IRS tax return.

How to Pay Tax

Every U.S. Resident is requires to pay tax along with IRS Tax Return. In case you have requested for IRS Tax Extension still you have to pay an estimated tax amount by the due date. There are four different ways for payment of tax as mentioned below:

- Tax Payment with Check

- Tax Payment with Credit Card

- Tax Payment with Debit Card

- Tax Payment with Digital Wallet

Tax Payment Processor List and Processing Fee Details

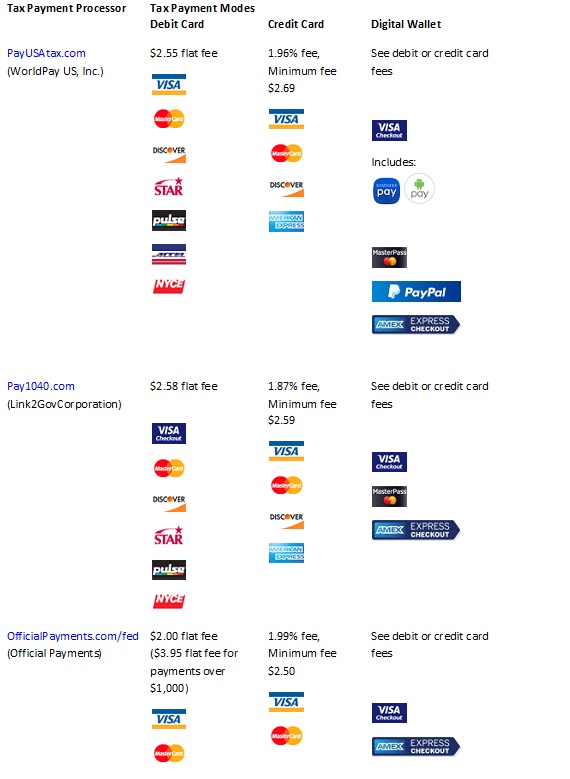

When you make your tax payment with credit card, you have to use a payment processor website. The processor site will charge processing fee for payment through their server. So you are required to pay the tax amount plus processing fee at the same time. The fee is 1.87% on Pay1040.com, 1.96% on PayUSAtax.com and 1.99% on OfficialPayments.com/fed. You can choose any of these payment processors to pay your tax.

Here we provide the tax processor list and fee charged by them as follows:

How to Pay Tax with Credit Card

In order to explain how to pay tax with a credit card, we will consider as if you are paying tax through PayUSAtax.com. Kindly follow the easiest steps mentioned below:

- Log on to the Tax Payment Processor Website at PayUSAtax.com.

- Choose your Tax Payment Type i.e. Make a Personal Payment OR Make a Business Payment.

- Select the Tax Payment Category as applicable and click on Continue. For Example: Pay Your 2019 Estimated Tax Form (1040-ES).

- Provide Your First Name, Last Name, Social Security Number, Date of Birth, Address and Contact Information.

- Enter the Tax Payment Amount and choose the payment option as Credit.

- Again click on Continue to go to Credit Card Page.

- Provide your Credit Card Number, Card Holder Name, Expiration Date and CVV/Secret Code.

- Submit the correct information to go to Final Payment Page.

- Save the Payment Reference Number as payment record and future use.

For proof of payment, the PayUSAtax.com provides you a confirmation number and digital time stamp on your tax payment receipt.

Limits and Restrictions on Tax Payment with Credit Card

Tax Payment with Credit Card is easy, fast and secure for every taxpayer. But it also has some restrictions on amount, frequency and tax deposits. Here we provide all applicable restrictions on tax payment with credit card.

- If the Tax Amount is more than $100,000, you may require coordination with your provider.

- You can make Federal Tax Payment and State/Local Tax Payments, but can’t make Federal Tax Deposits with Credit Card.

- You cannot get an immediate release of a Federal Tax Lien.

- You cannot cancel your payment after its process is initiated.

In addition to above limits, there are also some restrictions on how many times you can pay tax with credit card in a year. Here we provide complete details about Frequency Limit by Type of Tax Payment as under:

For Individual Tax Payers

| Form Name | Payment Type and Tax Year | Limit |

| Form 1040 series | Current Tax Year (2018) | 2 per year |

| Prior Year (1999-2017) | 2 per year | |

| Proposed Tax Assessment (2016-2018) |

2 per year | |

| Installment Agreement (1999 – 2018) |

2 per month | |

| Form 1040-ES | Estimated Tax (2018/Q4 & 2019/Q1-3) |

2 per quarter |

| Form 1040-X | Amended (2016 – 2018) | 2 per year |

| Form 4868 | Extension Payment (2018) | 2 per year |

| Form 5329 | Current Tax Due (2018) | 2 per year |

| Health Care – Form 1040 | Balance Due Notice Payment (2014 – 2018) | 2 per year |

| Proposed Tax Assessment (2016 – 2018) | 2 per year | |

| Health Care – Form 1040-X | Amended (2014 – 2018) | 2 per year |

| Trust Fund Recovery Penalty | Prior Year (1999 – 2018) | 2 per quarter |

| Installment Agreement (1999 – 2018) |

2 per month |

For Business Tax Payers

| Form Name | Payment Type and Tax Year | Limit |

| Form 940 series | Current Tax Year (2018) | 2 per year |

| Prior Year (1999 – 2017) | 2 per year | |

| Amended or Adjusted (2016 – 2018) |

2 per year | |

| Installment Agreement (1999 2018) |

2 per month | |

| Form 941 series | Current Tax Year (2018/Q4 & 2019/Q1-3) |

2 per quarter |

| Prior Year (1999 – 2018) | 2 per quarter | |

| Amended or Adjusted (2016 – 2018/Q1-4 & 2019/Q1-3) |

2 per quarter | |

| Installment Agreement (1999 – 2018) |

2 per month | |

| Form 943 | Current Tax Year (2018) | 2 per year |

| Prior Year (1999 – 2017) | 2 per year | |

| Amended or Adjusted (2016 – 2018) |

2 per year | |

| Installment Agreement (1999 – 2018) |

2 per month | |

| Form 944 | Current Tax Year (2018) | 2 per year |

| Prior Year (2016 – 2017) | 2 per year | |

| Amended or Adjusted (2016 – 2018) |

2 per year | |

| Form 945 | Current Tax Year (2018) | 2 per year |

| Prior Year (1999 – 2017) | 2 per year | |

| Amended or Adjusted (2016 2018) |

2 per year | |

| Installment Agreement (1999 -2018) |

2 per month | |

| Form 1041 | Current Tax Year (2018) | 2 per year |

| Prior Year (1999 – 2017) | 2 per year | |

| Form 1065 | Current Tax Year (2018) | 2 per year |

| Prior Year (1999 – 2017) | 2 per year | |

| Form 2290 | Current Tax Year (2018 & 2019)

Prior Year (1999 – 2018) |

2 per year |

When you pay your tax with credit card, you don’t need to pay immediately from your bank account. The tax amount will be added to your next credit card bill. If you pay tax right after preparation of your credit card statement, you will get 30+21 to 25 days credit period i.e. almost 51 to 55 days. It means you need to pay the tax amount to credit card company on completion of given credit period.

Thus, you can save your time, money and also earn rewards if you prefer to pay tax with your credit card.

Leave a Reply